Basel Norms Explained: The Future Of Banking Regulations

Ever wondered how banks across the globe maintain a semblance of order and stability? The answer lies, in part, with the Basel Norms, a set of international banking regulations designed to create a safer and more robust financial system for everyone.

The Basel Norms, also referred to as the Basel Accords, represent a collaborative effort orchestrated by the Basel Committee on Banking Supervision (BCBS). This committee, strategically based in Basel, Switzerland, serves as the primary architect and overseer of these crucial regulations. The core objective of the Basel Norms is to harmonize banking regulations worldwide, fostering a more resilient international banking system capable of weathering financial storms. To truly understand the impact, one must delve into the history, structure, and ongoing evolution of these accords.

| Attribute | Details |

|---|---|

| Name | Basel Committee on Banking Supervision (BCBS) |

| Location | Basel, Switzerland |

| Primary Function | Setting global standards for the prudential regulation of banks. |

| Key Achievements | Development and continuous refinement of the Basel Accords (Basel I, Basel II, Basel III). |

| Objectives | Enhance financial stability by improving the quality of banking supervision worldwide and promoting the adoption of best practices. |

| Membership | Central banks and supervisory authorities from major economies around the globe. |

| Website | Bank for International Settlements (BIS) - BCBS |

- Download Bollywood Hollywood Hindi Dubbed Movies Guide

- Unlock Math Easily Symbolabs Stepbystep Solutions More

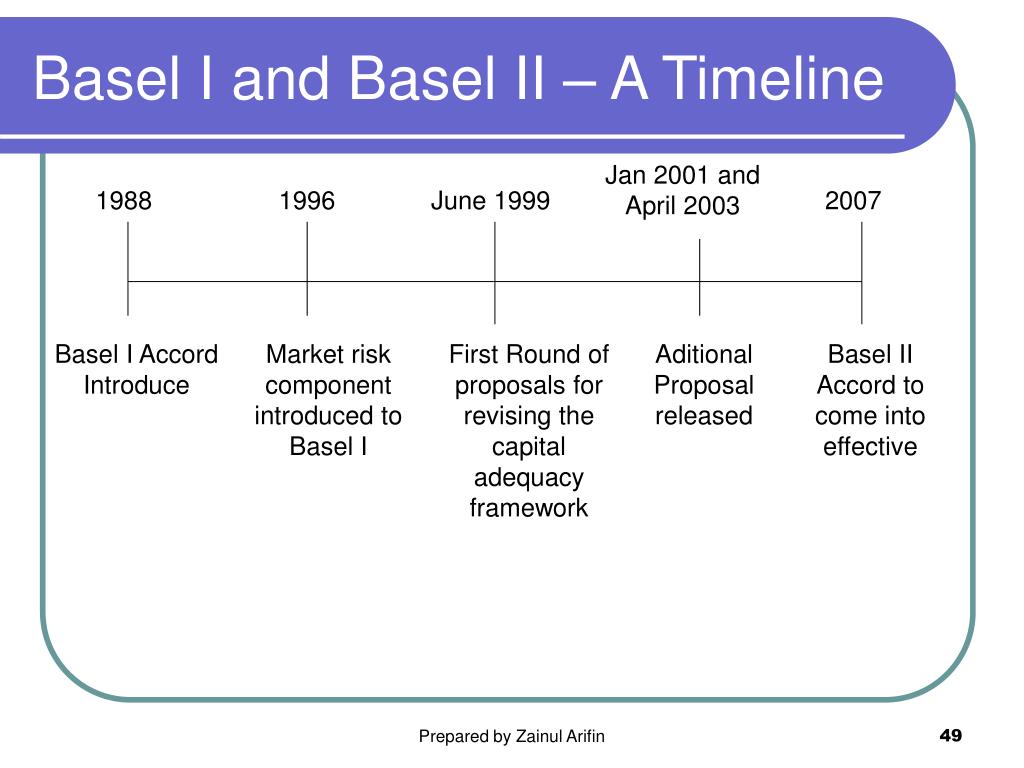

PPT The Basel I and Basel II Accords PowerPoint Presentation, free

Introduction to Basel 2 and Basel 1 Vs. Basel 2 YouTube

:max_bytes(150000):strip_icc()/BaselIIAccordGuardsAgainstFinancialShocks1-fb23a015d23643009e189c8f43c74a03.png)

Basel Accords Guard Against Financial Shocks